The Turbulent Rise, Death and Rebirth of Alt-Tech Media

Can Rumble become the anti-censorship movement's big success story?

Trump’s media company is a runaway success, so long as you look at its recent share price rather than any business fundamentals.

After merging with Digital World Acquisition Corp (DWAC) and going public on NASDAQ for the first time, Trump Media and Technology Group (TMTG) shot up to a record high of $66 per share, falling back down to around $46.

Retail investor enthusiasm for the stock has clearly been very high, with a market capitalisation of $6.3 billion (it was at $8.3 billion last week).

But the share price performance, including its volatility, has a lot to do with the lack of shares in circulation – Trump owns more than 50% of the stock and he’s locked-up for the next six months.

As for the business, its prospectus was very clear on one thing – it may never disclose user numbers for Truth Social, Trump’s social media app, or Truth+, the streaming platform TMTG plans to launch next year.

Investors would be therefore left in the dark over key performance metrics and are currently unable to compare the business with other listed social media companies, including Reddit, Snap, Meta and ByteDance, the owner of TikTok.

The business also lost $58 million in 2023, against revenues of just $4.1 million. “TMTG expects to continue to incur operating losses and negative cash flows from operating activities for the foreseeable future, as it works to expand its user base, attracting more platform partners and advertisers,” management told investors yesterday.

But, on the upside, TMTG has also claimed that it can bring in sales of $173 million in 2025 through Truth Social thanks to the financial firepower the merger with DWAC and the listing will give it.

The Original Proposition

TMTG was formed less than a month after Trump had left office and Truth Social was created in October 2021. The business later announced in December of that year that it would partner with Rumble, the alt-tech streaming platform founded in 2013.

Truth Social would use Rumble’s cloud services in a bid to avoid any censorship. The decision came after Amazon decided to drop another alt-tech platform, Parler, from its cloud services at the start of 2021.

Deplatforming became a theme for the year following the US Capitol Riots. The rise of Andrew Tate, once one of the most Googled people in the world, stirred up further controversy.

Tate’s followers had popularised the British-American by clipping his content and taking advantage of the rise of short-form video on platforms like TikTok, Instagram and YouTube.

Soon Tate would be banned and he would move to Rumble. SteveWillDoIt, a YouTube celebrity, also moved to the Peter Thiel-backed platform after his own ban. But so far the platform’s top streamer has been Steven Crowder, a modern-day conservative talk-show host who also made it big on YouTube.

Crowder has already made $7.5 million in subscription revenues from the platform, something Rumble made much of in a bid to attract more media stars to the platform.

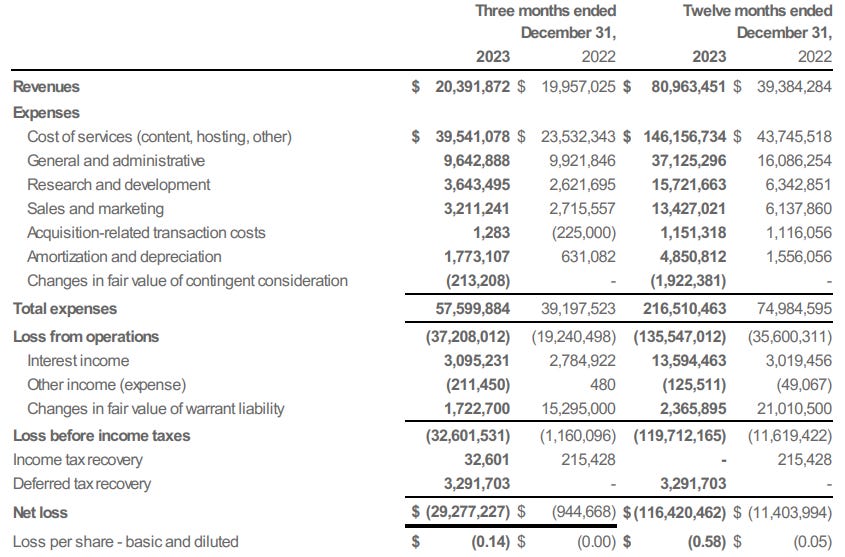

Rumble has been able to attract some of this talent by signing guaranteed contracts to creators, something the business expects to decline over time but currently accounts for the lion’s share of Rumble’s $146 million costs of service in 2023, a 240% increase on last year.

How Rumble Gets Creators

The platform also currently shares 60% of advertising revenue with streamers. By comparison, Twitch and YouTube creators can earn up to 55% (it’s reversed 45%/55% for YouTube Short creators).

“As they [creators] come off of contract, the plan is that we don’t have to renew those because as the monetisation tools start kicking-in the creators will start earning 60% ad revenue,” Rumble management told financial analysts on a recent results call.

The attractive financial offerings for talent has seen the platform grow its user base to a record 67 million users, with revenues of $81 million. But those costs of service, including other expenses, saw Rumble post a net loss of $116 million for 2023.

Talent evidently costs money and so does taking on the big boys of social media. But, unlike some technology companies, Rumble won’t be loss making forever, according to Chairman and CEO Chris Pavlovski. He wants to break even in 2025.

The business’ ad revenue system is really expected to start generating meaningful sales from the second quarter of 2024, with the minimum guarantee contracts to start falling away from the rest of 2024 and early 2025.

The fact that we are in an election year (RFK Jr. is on Rumble and is a cloud customer) and the platform has partnered with popular sports media brand, Barstool Sports (Dave Portnoy took an equity stake in the company as part of the deal), could further drive more eyeballs to Rumble.

But with Elon Musk’s acquisition of Twitter in October 2022, the launch of Threads by Meta in July 2023 and Bluesky’s roll-out this year, the platform choice seems broader than ever.

No doubt Rumble will argue that it is the only alternative video streaming platform in town, but video is now a core feature of all social media platforms. And Musk’s free-speech stance means right-wingers can no longer claim censorship on the website now known as X.

Elsewhere, the fate and user base of another alt-tech platform Gettr is unknown, while Parler is apparently set to re-launch for the 2024 elections. Kanye West said he was once buying the platform.

But one service which has done extremely well over the past few years is Telegram. The platform now has 900 million users and is even reportedly considering an IPO. The company’s financials, however, are unclear.

Pavel Durov, who co-founded the privacy-focused platform in 2013, told The FT in March that the app had sales of “hundreds of millions of dollars”. The Dubai-based business’ costs and bottom line were unclear.

Meanwhile, back in the traditional media world, the fallout from NBC News’ rapid hiring and firing of former Republican National Committee chair Ronna McDaniel has continued.

Should the politics-to-pundit conveyor belt be switched off, is the liberal media overcompensating for its endless coverage of Trump during his first presidential campaign or does this move simply mark the end of the ‘balanced broadcaster’?

Surely this type of moment is what alt-tech was built for?

🤔 Other tech and media news I’ve found interesting

Suella Braverman, one of Britain’s former Home Secretaries, has landed a columnist spot at The Telegraph. The right-leaning outlet is still on the market after the UK government intervened to thwart RedBird IMI’s bid for it. The publication, nicknamed ‘The Torygraph’. will wield an awful lot of influence over who becomes the next leader of the Conservatives. Now lagging around 20 points behind Labour, the party is expected to select a new leader after the next general election. That vote could come in June, October or even January, depending who you speak to.

OpenAI has decided not to ship or show any products, as its strategy has been in the past. Instead, Sam Altman’s company has this time warned that its voice cloning tool is currently too powerful to release to the public. Meanwhile, The Wall Street Journal is reporting that AI companies are finding it increasingly hard to access quality data to train their LLMs on.

The BBC is looking for a new tech correspondent based out of California.

The EU is having a big row over the roll-out of 5G networks, with the European Commission coming under fire.

Bloomberg has noted the rise of Lex Fridman. The former MIT computer scientist is effectively part of the extended Joe Rogan Universe. He has become a successful podcaster in his own right, interviewing some of the biggest names in the tech and science sectors. Meta’s Yann LeCun, Sam Altman and Tucker Carlson are some recent guests.

🎥 Video essays

📖 Essays

How disinformation is forcing a paradigm shift in media theory

Welcome to the age of electronic cottages and information elites

Operation Southside: Inside the UK media’s plan to reconcile with Labour

📧 Contact

For high-praise, tips or gripes, please contact the editor at iansilvera@gmail.com or via @ianjsilvera. Follow on LinkedIn here.

182 can be found here

181 can be found here

180 can be found here

179 can be found here

178 can be found here

177 can be found here