The Reddit IPO And The Election

How Steve Hoffman plans to take the social media platform public

I’ve broken down some of the main aspects and considerations of the planned Reddit IPO below. The listing prospectus, otherwise known as the S-1, gives us all a rare glimpse into the financial and operational workings of one of the internet’s most influential platforms.

The timing of the IPO will be of great importance for the equity markets, but it will also happen during a fully-fledged Presidential election campaign, adding an extra layer of complexity to the listing and potentially dwarfing — both politically and economically — Snap’s 2017 IPO.

Why is Reddit going public?

According to co-founder and CEO Steve Hoffman, Reddit wants to “advance our mission and become a stronger company”. This includes giving Reddit users a sense of community and “real ownership”.

To do this, Reddit will reward 75,000 super-users and moderators to buy in at the IPO price, something which is normally reserved for institutional investors who cornerstone or put massive stakes (and manage massive risks) in an IPO. The company is also setting aside 1% of its Class A common stock over 10 years to fund community-related initiatives.

The funds raised from the IPO will also help Reddit grow its advertising business, userbase (100,000 active communities and 267 million active weekly users), improve its data licensing business and launch a “user economy”, which includes the establishment of “informal exchanges” of digital goods, services, and even physical goods.

Reddit estimates the total addressable global market for commerce to reach $2.1 trillion in 2027, significantly above the total addressable market for advertising at $1.4 trillion.

The background to this month’s announcement is that Reddit was reportedly exploring an IPO in 2021, but macroeconomic uncertainty stopped it from pursuing the listing. The company then went on to appoint Dave Habiger, a veteran of publicly-listed companies, as chairman in November 2022.

Who else benefits from the IPO?

Hoffman’s current shares in Reddit (396,762 of common stock) will vest if the company reaches a market cap’ of at least $5 billion (Snap’s MCAP is currently around $17.6 billion).

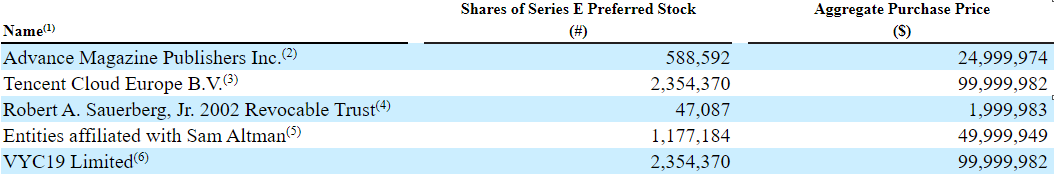

OpenAI’s Sam Altman could also be a big beneficiary of the IPO as the business’ third largest shareholder, with a 8.7% stake. Other major shareholders include Advance Publications, Fidelity, Quiet Capital, Tencent, and Vy Capital.

Investment banks on the ticket, including Morgan Stanley, Goldman Sachs, JPMorgan, and Bank of America, will have their own deals with the business — whether that is based on a percentage of a successful IPO or a retained fee.

The macroeconomic landscape

Reddit’s decision to IPO in Q1 or Q2 of 2024 is not only a vote of confidence for the New York Stock Exchange, the market it plans to list on (like Snap) instead of NASDAQ, but also the US economy more generally.

Though inflation continues to look sticky, despite the heightening of interest rates (between 5.25 and 5.5%) by the US Federal Reserve, the American economy showed strong growth in the final quarter of 2023, with a 3.3% GDP increase.

Reddit, with its flagship IPO status, could be a stalking horse for the rest of the tech-media market for 2024. The other hotly anticipated listing is an alleged IPO from Skims, Kim Kardashian's consumer brand.

Is profitability a problem?

One of the biggest questions the IPO will partly answer is how much weight tech-media investors in the US put on profitability. The mood music has changed from the pre-Covid days, when companies would get an extensive backing because of their growth potential.

But we know from Reddit’s IPO filing that the business made a net loss of $90.8 million in 2023 against revenues of $804 million and with a free-cash-flow of $84 million, down from $100 million in 2022.

Reddit has outlined some of its growth plans and new revenue streams in the prospectus, including data licensing for machine learning, business analysis, display and training generative AI models.

Another potential but related issue for the IPO team is how Reddit is peered, namely how investors and analysts compare it to other companies.

If you take a key financial metric, its Average Revenue Per User (ARPU), it matches favourably at $3.42 with Snap’s $3.29. But if you broaden the peers and competitors out to the likes of Netflix, with an ARPU of $11.76, Reddit doesn’t look as attractive.

The timing and the political landscape

Based on the S-1 now being made public — an act any company has to do at least 15 days before they go on an investor roadshow — it is likely that talks with potential shareholders will begin in early March, with Reddit possibly going public in late March.

The investment bank teams and the company’s management would have also likely conducted ‘test marketing’ well before going ahead with the S-1 process.

This initiative allows the business to pitch to a very limited number of potential investors, who can give good and early feedback on whether the IPO will get away or not.

Some major political events in March include President Biden’s State of the Union address on 7 March and Donald Trump’s criminal trial in New York, which will kick-off on 25 March.

Investors and analysts on Wall Street will also be keeping their eyes on the latest job numbers, GDP figures and inflation rates across this period to gauge the strength of the US economy.

All in all, the White House election campaign will be ramping up “bigly”, to quote a phrase, and we will all have a better idea of whether the world’s biggest economy will enter a recession in 2024 or not.

What are the risks?

S-1 forms are infamously long when it comes to outlining potential risks of an IPO and it’s no different for Reddit, with the company flagging to potential investors that a failure to grow its community and a change to internet algorithms could have a detrimental impact on the business.

But arguably by far the biggest risk is around generative AI and content moderation, mixed in with the fact that Reddit could face much more scrutiny than ever before ahead and after the US election.

The company has made a concerted effort since 2019 to identify and mitigate bad actor behaviour on its platform, following reports that it was a hotbed of misinformation during the 2016 elections. Reddit has a three-tiered approach to moderation: at site level, community level and user level.

“We believe it is vital that Redditors understand and participate in how content is ranked and displayed inside of communities. Our system is unique in the industry and we believe avoids many problems that come with more complex content ranking algorithms,” Reddit’s IPO prospectus states.

“Anonymous voting creates a single, shared view of community posts that enables all community members to see the same content and to build culture and consensus together.

“Therefore, each individual Redditor plays a crucial role, voting up or down on posts and comments. Through this system of voting, Redditors can accept or reject any piece of content.

“While most platforms have some version of the upvote function—an action to convey approval or agreement—we at Reddit see the additional downvote as equally important. The downvote is where community culture is made, through rejecting transgressive behaviour or low-quality content. Reddit’s voting system turns every Redditor into a content moderator.”

What next?

Usually companies will enter a quiet period as their senior management teams and bankers travel to see potential institutional investors in locations like New York, San Francisco and Chicago.

Then, nearer to the actual IPO day, news may break of the proposed IPO share price and market cap’ expectations. But given Reddit’s commitment to its moderators and users, it is likely that the company will provide an update in the coming weeks, outlining more information on how retail investors can take part in the listing.

Other things I’ve found interesting

There’s still a massive debate raging in the AI research community over generative LLMs and whether hallucinations are a feature or a bug of the technology. Meta’s Yann LeCun wants to ditch generative AI.

Talking of which, Google could apparently re-launch its Gemini product in the coming weeks after a mass backlash against the generative AI image making tool. Bias and stereotyping remain huge issues for this type of technology, mainly because of the databases they are used to ‘train’ from.

A rare tale of someone in the UK making it big in the media whilst avoiding London. It’s £7, almost $9, for a pint in the Big Smoke nowadays.

In a sorry state of affairs, UK MPs must now employ bodyguards to keep safe. There has been little to no commentary on what I’m calling the lazy surveillance state, where police and other law enforcement officials prefer taking pictures rather than stopping crimes.

SkyNews has launched a new transparency tool so voters can figure out how their MPs are funded. Many political parties — and charitable causes for that matter — highly rely on people leaving donations in their wills. It brings up the mysterious case of mechanic Billy Hampton, who passed away in 2018. An Englishman who spent his final years living in a campervan, Hampton’s estate has given millions to the Irish Republican party Sinn Féin.

🎥 Video essays

📖 Essays

How disinformation is forcing a paradigm shift in media theory

Welcome to the age of electronic cottages and information elites

Operation Southside: Inside the UK media’s plan to reconcile with Labour

📧 Contact

For high-praise, tips or gripes, please contact the editor at iansilvera@gmail.com or via @ianjsilvera. Follow on LinkedIn here.

176 can be found here

175 can be found here

174 can be found here

173 can be found here

172 can be found here

171 can be found here

170 can be found here