How gaming can take news to the next level

Future Media 136

Here’s a strange one: The world’s most popular streamer is now promoting The New York Times. It’s not in a way you would traditionally imagine for a news media brand. There’s no sharing of the publication’s top stories, an endorsement of its op-eds or readings from some of its ground-breaking journalism.

Instead, The New York Times’’ latest and greatest acquisition, Wordle, is regularly being beamed to hundreds of thousands of followers on YouTube by a 40-something, fake-moustache-wearing former college basketball star whose fictional memoir is called Violence. Speed. Momentum.

Welcome to the world of Dr Disrespect, where Wordle is used as a warm-up before dropping into fast-paced first-person shooters such as Call of Duty’s Warzone, Fortnite and Apex Legends, three battle-royale titles that boomed during the pandemic as gamers were consigned to their living quarters and socialised through headphones.

Unless they are willing to splurge bigly, news media brands won’t be able to compete in the AAA gaming space Dr Disrespect and his fellow streamers play in, nor should they. But the continued success of Wordle shows there are plenty of legs in the casual, puzzle and mobile gaming space. This is part of the wider attention economy that news media outlets have to compete in everyday – whether they like it or not.

The precedent for embracing gaming is obvious. Crosswords (invented by British-born journalist Arthur Wynne) and other puzzles, most notably Sudoku, have become staple tie-ins with newspapers and their online equivalents because of the intellectual stimulation they bring.

Beyond these traditional puzzles there is plenty of innovation out there. Candy Crush, the tile-matching video game, is still very popular, as any eagle-eyed commuter can attest to. And before Wordle, Zynga’s Words with Friends, a multiplayer crossword-style game, was all the rage.

All of these titles have some common qualities: they are free-to-play, available in app form (as well as desktop) and they are highly repeatable, making them a little bit addictive. Unlike their AAA counterparts, they also don’t cost excessive amounts of capital to develop.

The naysayer news media executives would dismiss the gaming boom as a fad. The evidence points to the contrary. And, despite a recent slump in creativity and big name title releases (Call of Duty Modern Warfare II is slated for the end of October), the sector is set to dominate the media industry at-large.

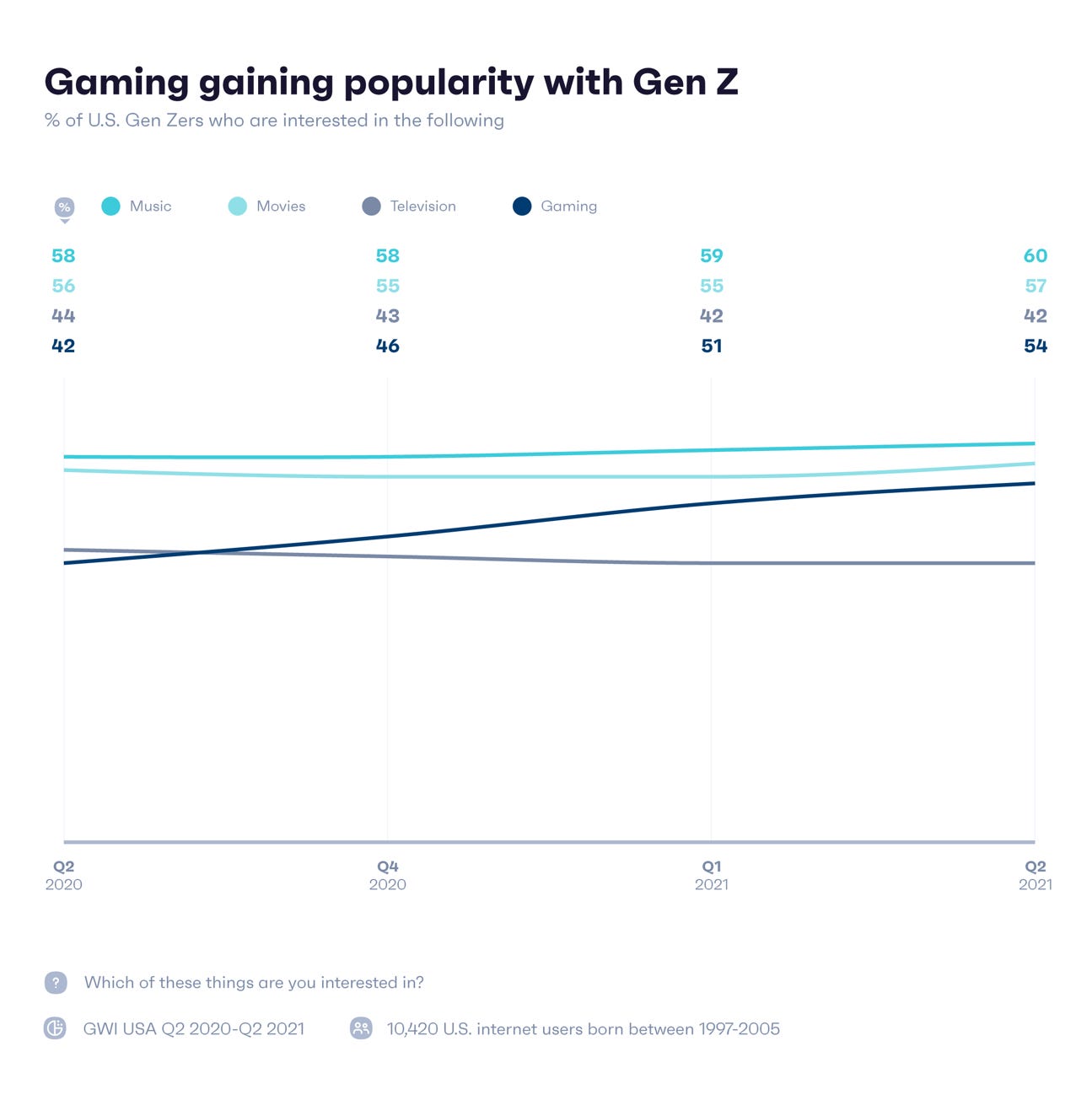

You may be surprised to learn, for example, that the average gamer is 31-years-old, with even 56-year-old ladies joining the action. And the media sector is gaining popularity with Gen Z (10 to 25). The Global Web Index survey has gaming overtaking movies, TV and music in the very near future amongst this age demographic in the US.

In the UK, gaming is the mainstream, with 60% of adults indulging in the medium, according to regulator OfCom. There was naturally a peak (62%) during the pandemic when government restrictions were in full force in 2020, but the proportion of adult gamers is still well-above pre-Covid-19 levels and that is set to grow.

Unsurprisingly, the most common device used for playing games was a mobile phone (37%). The hyper-casual gamer, otherwise known as the commuting gamer, has become a recent phenomenon due to the rise of smartphones and good internet connectivity (this will only grow on the back of the 5G rollout).

These are just some of the strong tailwinds behind the sector. For The New York Times, which has heavily focused on subscriptions since its paywall was erected in 2011, gaming is part of its overall strategy to attract more readers across the board. This also includes its NYT Cooking service.

Here’s what Meredith Kopit Levien, president and CEO of The New York Times Company, said in May about it:

“Wordle brought an unprecedented tens of millions of new users to The Times, many of whom stayed to play other games which drove our best quarter ever for net subscriber additions to Game...”

The business should be seen more as an infotainment brand, rather than a pure news media play. Events have always been a natural off-shoot and additional revenue stream for news media brands, while the likes of The Economist and others have established intelligence and research businesses. Gaming should be the next logical move.

Beyond The New York Times, this is something that the UK's Telegraph is experimenting with via PlusWord. Its quality news rival, The Times, has a less prominent puzzle section, and is pushing its radio offering more. The Washington Post, which is apparently set to fall out of profitability and is reportedly pursuing a rather mixed M&A strategy, is even more lacklustre in its gaming placements. Solitaire and Crossword widgets sit right at the very bottom of the outlet’s home page.

If anything else, The New York Times case study shows us that gaming needs its own due care and attention, including dedicated marketing and quality space in-app and on-desktop (rather than being hidden away as an afterthought).

There is also a level of unbundling which needs to be considered by the news media industry. Should publishers allow readers to subscribe only to gaming or other popular standalone verticals rather than their full-fat offering? If consumers are getting to these sub-brands and businesses first, there’s a case for it.

To give you an example from elsewhere: I, for one, have been frustrated with Politico Pro and the inability to subscribe and pay for a select newsletter of choice. The outlet’s current business model forces you to sign-up for the whole Pro offering. My money will go down the drain on news products I don’t want and will never read. No thanks.

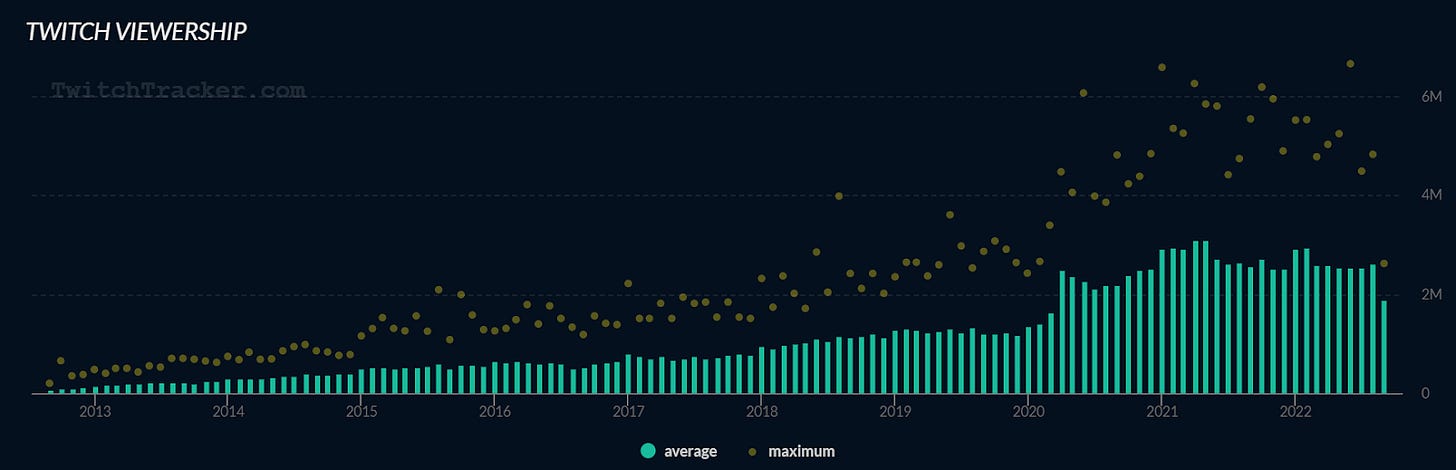

These bundling and wider subscription questions are also being thought about by other parts of the media industry. Netflix is increasingly releasing new titles on its mobile app, while Amazon Prime has its own gaming service as well as streaming platform in Twitch. Everybody is trying to get a little bit more sticky as recession looms.

The other important macro-factors relate to the gaming industry itself. As I’ve briefly previously mentioned, the industry is currently in a lull. There have been no big releases and no major innovations over the past year. The situation has been exacerbated by supply-chain issues, creating a microchip shortage and a hardware slowdown in the short-term.

The outlook, however, looks optimistic in the medium and long-term. Epic Games’ free-to-use Unreal Engine 5 was released in May, with a slew of major gaming titles building on the engine. Activision, the Call of Duty and Warcraft publisher, is still completing its acquisition with Xbox-owner Microsoft – in a move which Warren Buffett’s Berkshire Hathaway has seemingly backed. And the eSports scene and streaming is in a very strong place.

With the gaming industry AFK (‘away from keyboard’ for the uninitiated) for the time being and the holiday season coming to an end, now is the optimum time for news media brands to reconfigure their growth strategies and factor the ongoing rise of gaming into the mix alongside video, alongside podcasts and alongside newsletters. After all, it’s only been 109 years since the first modern crossword appeared in The New York World.

FM is read by hundreds of readers. I would like to make it thousands. Please subscribe and share.

📺 Media news of interest

📖 Essays

📧 Contact

For high-praise, tips or gripes, please contact the editor at iansilvera@gmail.com or via @ianjsilvera. Follow on LinkedIn here.

FM 135 can be found here

FM 134 can be found here

FM 133 can be found here

FM 132 can be found here

FM 131 can be found here

FM 130 can be found here