Why The Big Short Bros Are Back

Steve Eisman, Michael Burry and Michael Lewis are the new 'end cycle' media stars

Being early is the same as being wrong, is what they’re tell you on Wall Street. It’s a warning Dr Michael Burry has enthusiastically leaned into with his new blockbuster newsletter, Cassandra Unchained.

For the uninitiated, Cassandra was a figure in Greek mythology who was given the gift of prophesy by the gods. But in a cruel turn of events Cassandra was also cursed — nobody would believe her predictions.

Burry has cast himself as a modern-day Cassandra. As a contrarian hedge fund manager at the now defunct Scion Asset Management, he estimated that the US housing market would blow-up in 2007.

The rapid rise of the subprime adjustable-rate mortgage industry, catalysed by the trading of derivative financial instruments, meant that consumers with little or no creditworthiness could take out massive loans for residential properties.

As the borrowing rates soared, typically from the second or third years of these mortgage agreements, delinquency rates would climb.

Since 2003 Burry had been pulling the prospectuses of the financial instruments, known as mortgage-backed securities and the riskier collateralised debt obligations.

He noticed that these bundles of securities or tranches were increasingly being packed with riskier and riskier loans. In other words, their credit standards were deteriorating.

But despite these warning signs, a mixture of greed and leverage had taken hold at some of the world’s largest financial institutions, leaving them exposed to this increasingly dangerous paper as “crappier and crappier mortgages” were being sold and re-sold at an unforeseen scale.

To ‘short’, or bet against the market, Burry had to literally create a new form of insurance against mortgage-backed securities defaulting. Some major Wall Street banks agreed to sell Burry these derivative insurance products in the shape of credit default swaps.

This was in 2005, years before the Great Recession. Some of Scion’s investors became increasingly frustrated with Burry because he had to pay out premiums on the credit default swaps. In total, Scion was reportedly drawn down by $100 million.

After a flurry of redemptions from his fund, Burry would reduce his $8 billion exposure to credit default swaps to $2.3 billion in a bid to appease his investors.

He would have to wait until mid-2007, when the housing market started to crack and delinquency rates soared, for his hypothesis to be proven correct.

In the end Scion made more than $725 million on the trade, netting $100 million for Burry. Even on those returns, some of Scion’s investors were still pissed off.

Burry later became became a micro-celebrity thanks to Michael Lewis’ 2010 The Big Short, with the 2015 film of the same name and a portrayal from Christian Bale further boosting his fame.

Self-diagnosed with Asperger’s Syndrome, Burry thereafter kept a low profile publicly and rejected most media interviews. He did, however, build a cult following on Twitter (now X), where some of his pronouncements on the economy and equity markets went viral.

A cottage industry of following hedge fund managers and their bets was also created around him. With YouTube videos (link), forum posts and articles published on Scion’s quarterly 13F filings, the form hedge funds have to submit to the Securities and Exchange Commission to disclose their top positions.

But Burry called it quits as a hedge fund manager in November, announcing that he would close Scion down and create the Cassandra Unchained newsletter:

“After 25 years managing various Scion funds professionally, I’ve left the hedge fund business to focus on what I’ve always loved: writing and sharing investment ideas.

In the 1990s, I published Valuestocks.net, which Forbes twice named “Best of the Web,” and I wrote for Microsoft’s MSN Money as the Value Doc. For many years, my Scion Capital investor letters did all my marketing for me. Cassandra Unchained is a return to the public forum — and man am I excited.

Running money professionally came with regulatory and compliance restrictions that effectively muzzled my ability to communicate. These constraints meant I could only share cryptic fragments publicly, if at all. Without comment or clarity from me, news media has wildly misinterpreted many of my mandatory SEC filings — even causing havoc in markets as well as angry debates that I never intended.

That is all over. Cassandra, as Warren Buffett called me during his testimony to Congress about the GFC, is unchained…”

The outlet, with an annual subscription price of more than $380, has more than 155,000 total subscribers and has proven to be a coup for Substack, with Burry bringing his audience over from X and attracting new followers to the platform.

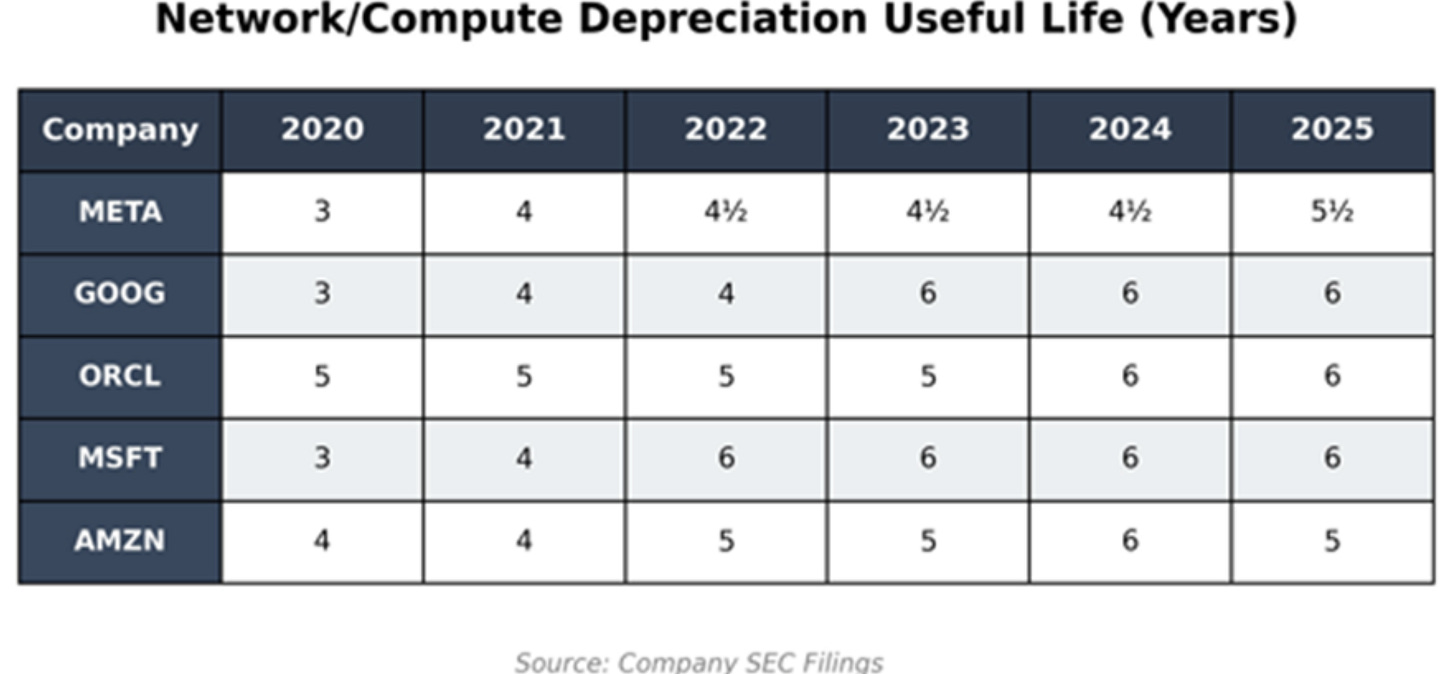

His new hypothesis is that technology stocks, especially those with a strong exposure to the generative AI boom, are overcooked. Burry has claimed that AI companies are allegedly inflating their earnings through accountancy tricks, namely by extending their depreciation schedules from three-to-five years up to six.

In short, this would mean AI rigs would last and be in demand for longer. Burry doesn’t buy it and has subsequently betted against leading chipmaker Nvidia, with the company pushing back (link).

The industry has argued that the demand is there, while others have pointed out that it’s too early to tell how long these bleeding edge processors will be financially viable for.

And though they are now being using for large-language-model scaling, their compute will be needed for AI app usage, known in the industry as ‘inference’. As such, moving the depreciation schedules out to six years is reasonable.

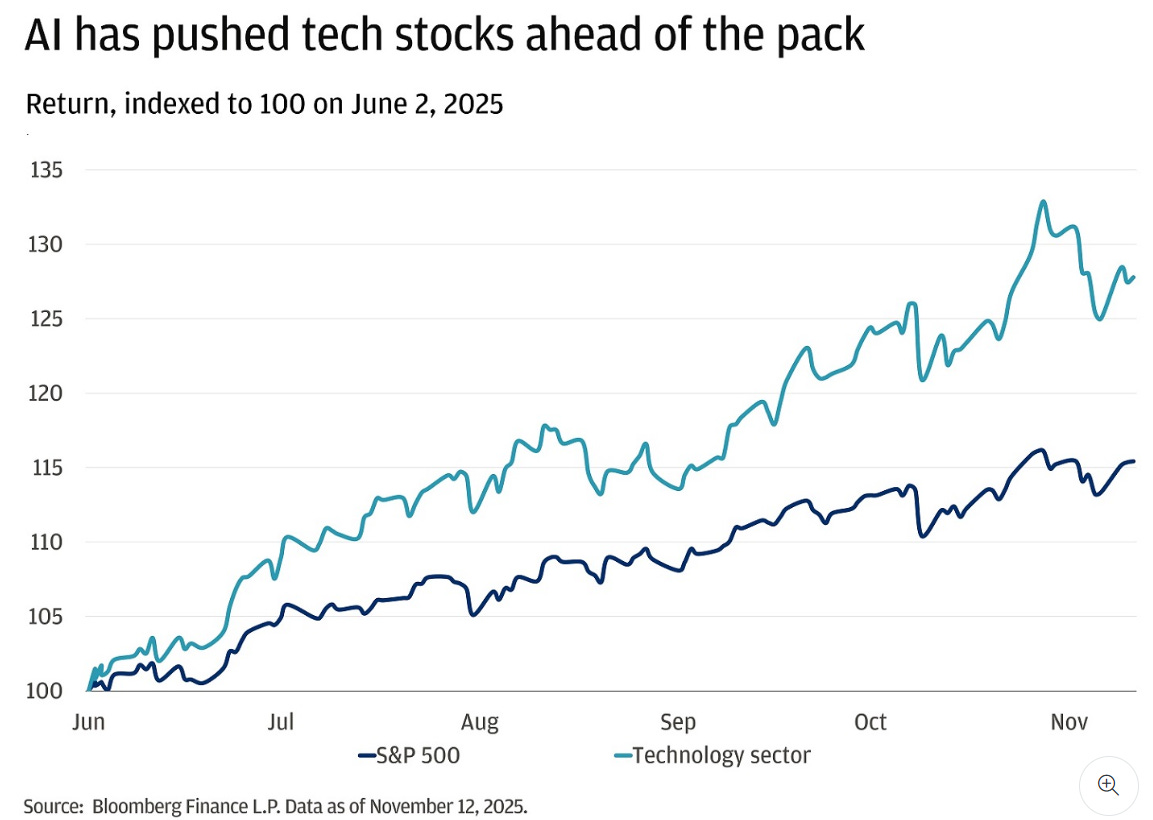

Either way, Burry’s intervention has fed into the wider ‘AI bubble’ narrative, with financial commentators noting the incredible rise of the ‘Magnificent Seven’ technology stocks over the past decade. Oracle’s latest earnings announcement (link) added fuel to the fire.

The company didn’t meet Wall Street’s estimations, with the Oracle’s debt pile rising to $108 million (link). A report from Bloomberg on Friday poured salt onto the wound (link), triggering another stock sell-off.

Reporter Brody Ford claimed that Oracle had pushed back the completion dates for some of the data centres it is developing for OpenAI to 2028 from 2027. Labour and material shortages were reportedly blamed.

Another Big Short alumni, Steve Eisman, is taking a more measured approach to the ‘AI bubble’ debate. Like Burry, Eisman betted against the US mortgage market as boss of FrontPoint Partners. But his short was put on later, in the autumn of 2006. A frequent contributor on CNBC, Eisman has admitted that he’s a holder of the some of the biggest technology stocks. He’s not selling (link), at least for now.

But Eisman has aired some contrary opinions through his new(ish) podcast, The Real Eisman Playbook (link). The show, which is across all of the main platforms, has already amassed more than 6.5 million views on YouTube. With a preference for interviewing independent financial analysts (he trusts them more), Eisman is able to breakdown some of the most complex business practices for the layman.

For retail investors, this type of information is gold. The institutions have to pay big bucks for this analysis, while Eisman gives this out to the world for free via his studio in New York.

A recent highlight was his sit down with Nigel Coe from Wolfe Research (link), an analyst focused on data centres. The industry is at the crossroads of the technology and industrial sectors, with these ‘bit barns’ providing the building blocks for the AI revolution.

Coe and Eisman went through some of the biggest players in the space, including CoreWeave, a former crypto mining business turned AI hyperscaler, and outlined the bull and bear cases for the stocks.

Eisman’s Socratic method of simply asking ‘why?’ or ‘how?’ throughout the course of a the conversation is deadly effective in an industry prone to jargon and suspectable to hype trends.

You can see why he called bullshit on the subprime mortgage market when most people though house prices could only go up.

As for Michael Lewis, his Against The Rules podcast has had a mini-revival thanks to a recent and rare interview of Burry (link). His last book project, 2023’s Going Infinite, raised eyebrows after Lewis got close (some critics say too close) to Sam Bankman-Fried, the now convicted fraudster.

Here’s how Emma Brockes in The Guardian (link) reviewed the book:

“Lewis tells the story of Bankman-Fried’s swashbuckling rise with predictable brio, but there is another, trickier side to the tale and here, Lewis struggles.

He tries to get around the huge question mark over his subject’s character by telling an opaque parable about a man called Bob – the moral of which is do we ever, really know our friends – but it doesn’t disguise the fact that Lewis can’t bear to think ill of his subject.”

It was a rare miss for the Californian-based Lewis, whose bibliography also includes Liar’s Poker, Moneyball and Flash Boys. But much talk of an ‘end cycle’ in the equity markets, something that could be similar to the Dot Com crash of the early 2000s, could re=popularise the author and give him much more material to write about.

My other writings on the AI boom

Are LLMs the way forward? (link)

Inside Big Tech’s nuclear dream (link)

The UK’s AI strategy (link)