Another Committee Might Kill Crypto in the UK

How bureaucracy and complacency damaged the digital assets dream

When VC royalty Andreessen Horowitz announced that its first international office would be in London, Rishi Sunak’s government had a real coup on its hands. For a long-time Paris had sought to woo frontier technology investors over.

The French hadn’t quit the EU, they were willing to throw a giga-load of grant money at foreign companies and President Macron was more than happy to roll-out the red carpet.

But a16z, the fund’s cooler name, was after something even more valuable – it wanted access to a burgeoning ecosystem of crypto companies and their founders (link). Unfortunately Paris didn’t have that, but London did.

The move from a16z was also politically opportunist. It came when the US’ Securities and Exchange Commission (SEC), then under Gary Gensler, was cracking down on the blockchain sector.

If Joe Biden’s America didn’t like this very global industry, it would simply up sticks and re-base in Europe and the Middle East, so the theory went.

For Sunak, a graduate of Stanford and a self-styled technology enthusiast, a16z’s decision was music to his ears. As Boris Johnson’s Chancellor in 2022 he had promised to make the UK a “global hub for cryptoasset technology”.

This commitment built on the recommendations in the landmark Khalifa Review (link).

The 2021 report, which reviewed the country’s fintech ecosystem, warned that the UK had great potential in the digital assets sector, but it had to move quickly because of international competition:

“The UK already has a strong position that it should capitalise on, but other jurisdictions are developing their own propositions (such as the EU’s Markets in Crypto-Assets (MiCA) proposal) and the UK needs to act quickly to preserve its position.

“The UK should aim to be at least as broad in ambition as MiCA – but should also consider whether it can develop a bespoke regime that is more innovation-driven.”

The situation was looking even rosier when Coinbase, the world’s largest listed crypto exchange, got in on the act and urged the government to roll-out a clear regulatory framework so that more digital businesses could operate and be born in Britain.

The companies teamed with Westminster think-tanks to host discussions at the party conferences, publish whitepapers about how the UK could be a world leader in crypto and Coinbase attempted to drum-up grassroots support through its Stand With Crypto campaign (link).

For its part, A16z threw its big guns at the initiative, namely Brian Quintenz, then the VC’s global head of policy, who wore through a considerable amount of shoe leather in London meeting and greeting the great and the good of the SW1 scene. Quintenz would later be selected by Trump to become the chairman of the US’ Commodity Futures Trading Commission.

But for all the time, money and resources the industry devoted to getting the UK on the global stage, including CryptoUK, the trade body I’m associated with, Sunak’s crypto ambitions seemed to have burnt out by 2024.

By the first half of that year, the UK’s financial regulator, the FCA, had imposed money laundering regulations on cryptoasset exchange and custodian wallet providers, banned the sale of cryptoassets-backed Exchange Traded Notes (cETNs) to retail consumers (in a move which is now, in 2025, expected to be overturned) and extended financial promotion restrictions to cryptoassets.

But despite these interventions, the UK industry remained without a comprehensive regulatory framework to operate in.

The Prime Minister was more interested in another frontier technology, the rise of generative AI. Crucially, ChatGPT had been unveiled in March 2023 – a couple of months before a16z’s London announcement.

Enamoured by the potential of LLMs, Sunak went on to host the first international AI Safety Summit at the famous home of the World War Two codebreakers, Bletchley Park, where the Prime Minister was able to interview Elon Musk live on X.

Just two months later in January 2024, the SEC would approve the first spot Bitcoin ETF, while the EU’s comprehensive MiCA Act continued to roll on into its implementation phase. The British tech trade media began to ask the obvious question (link): was Sunak’s cryptoasset hub dream dead?

It was a moot point by the summer of 2024 as Sunak had triggered a surprise general election, ran a lacklustre campaign (link) and lost power to Sir Keir Starmer, who had secured a thumping majority of more than 170 seats in the House of Commons.

Labour had made no mention of crypto in its manifesto, though the party did promise to help turn the country around by boosting digital infrastructure. It was only at the start of 2025 when the Chancellor Rachel Reeves started to make positive soundings towards the industry.

In April, citing FCA figures that more than 12% of the UK adult population had some sort of exposure to crypto, she promised to make Britain the “best place in the world to innovate — and the safest place for consumers” (link).

The FCA’s 2024 consumer research

93% of UK adults have heard of cryptoassets

12% of UK adults own cryptoassets – extrapolated to around 7 million adults

Increasingly, consumers are:

considering cryptoassets as part of ‘a wider investment portfolio’

influenced by ‘friends and family’, with 20% of people stating this was the main reason for purchase

buying cryptoassets either through their own long-term savings (19% in 2022, 26% in 2024) or through use of a credit card or overdraft (6% in 2022, 14% in 2024)

Under the new rules, crypto exchanges, dealers and agents would be brought into the regulatory perimeter.

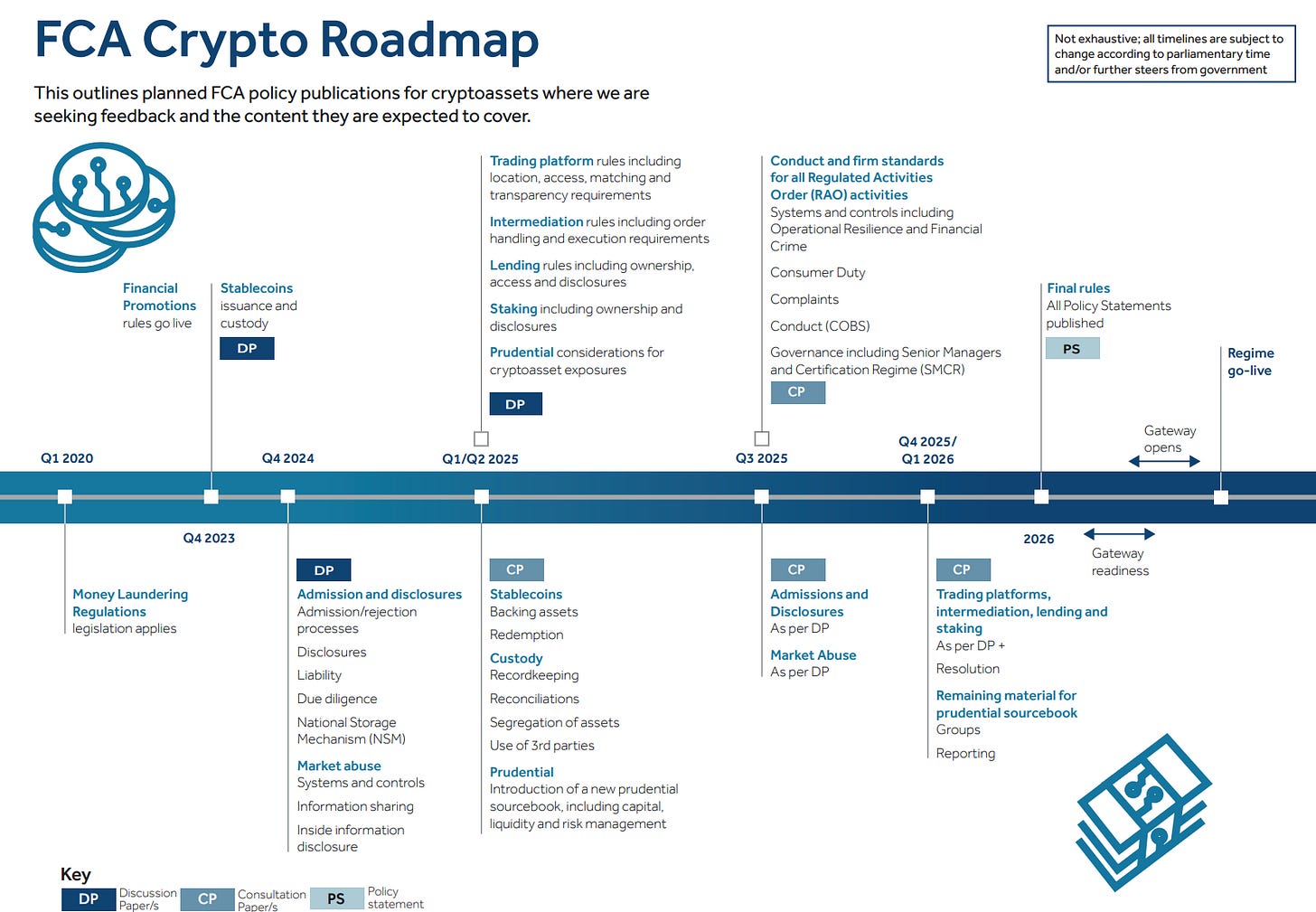

The FCA had also published its own regulatory roadmap (link), giving some much-needed transparency and a timeline on what would be coming next.

Progress, at last. But groans amongst the crypto industry began to be voiced again when reports claimed that the Bank of England was souring on its stablecoin ambitions (link).

Regulatory purgatory and ‘innovation’ by government-backed committees could seal the industry’s fate in the UK, something Coinbase and George Osborne, the former Chancellor, have now sounded the alarm on (link).

If the Chancellor really wanted to take on these paternalistic tendencies, she should set the UK’s crypto framework into law. The US is already well ahead, the Middle East is catching up, Britain’s big crypto advantages are fading.

The Political Press Box

Find my latest long-form audio interviews of political communicators here. Please like, subscribe and listen.

📧 Contact

For high-praise, tips or gripes, please contact the editor at iansilvera@gmail.com or via BlueSky (link). Follow on LinkedIn here.

215 can be found here

214 can be found here

213 can be found here

212 can be found here

211 can be found here

210 can be found here